This post is Part 2 of a three-part post series dedicated to the integration process of M&A. In this series, we explore eight core steps that, when approached with intent, drive a higher likelihood of success.

In "9 Success Factors for M&A integrations (P1)", we explored the aspects that help you prepare for the journey ahead:

- Introduction

- Success Factor 1: Achieve clarity in purpose, direction and vision

- Success Factor 2: Building bridges!

In Part 2 (this post), we focus on guiding you to build a plan of action with cross-functional engagement:

- Success Factor 3: Prepare your own business for the effort needed

- Success Factor 4: Manage risk and warning signs with intent!

- Success Factor 5: Proactively use the time interval between signing and closing!

In "9 Success Factors for M&A integrations (P3)", we will focus on bringing the plan to life:

- Success Factor 6: Develop an integration strategy for Day 1

- Success Factor 7: Execute with confidence!

- Success Factor 8: Be prepared to handle the hard truths about integrations

Let's continue…

Success Factor 3: Prepare your own business for the effort needed

By this stage we

- Established the theme and tone of the acquisition

- Set the basis on which to identify assumptions

- Understand the stakeholder landscape

Work with the acquiring cross-functional leadership to ensure an appreciation for the type of planning and decision-making required from them, such as:

- Named team members assigned to support this integration (generally the same people reviewing due diligence documentation)

- Effort to support requirements (for meetings, planning, milestones, data review, travel etc.)

- Integration approach being considered.

- Readiness to take on incoming teams (role mapping, capacity planning and work responsibilities.)

- Mutual strengths and weaknesses

- Definition of success on a functional level

- Identifying KPIs to be measured along the journey.

- The necessary "TLC" needed to address internal fears, uncertainties and doubts (e.g. risk of impact to current commitments etc.).

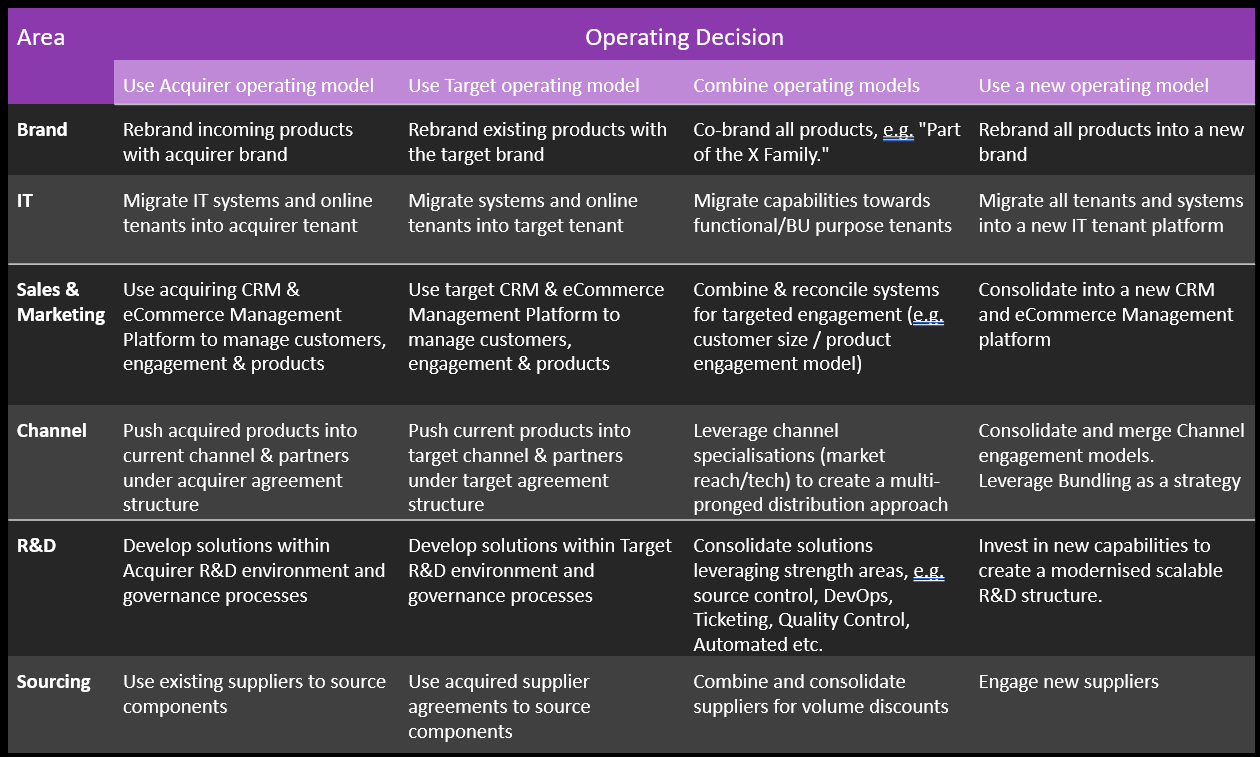

Using an example, typical decisions that need to be mapped in a software business acquisition across both the short, medium and longer-term:

Success Factor 4: Manage risk and warning signs with intent!

Make sure that

- Decisions are being taken and

- You identify decisions that impact cross-functionally are not being made in a silo.

- If any conflicts detected, raise them with haste

Example 1

Using an example, in an age of account-based marketing (ABM) and customer-centric account management, you need to ensure a common understanding of if, where, and how the data related to customers will be managed in the short/medium and beyond terms.

This simple point impacts

- Operations (for billing, licensing, renewals, invoicing)

- Support (for support entitlement, history tracking, NPS)

- Sales (opportunities, upsell opportunities, customer state, context)

- Marketing (multi-touch attribution, campaign to MQL scoring)

- Finance working on KPIs and data intelligence such as deal size, engagement, average revenue per customer demographic etc.

Example 2

Another example is the sourcing of technology/supplies. Map out an understanding of which suppliers can be consolidated to leverage higher volumes of the combined business in terms of better pricing, supply coverage, or service levels. Identify which vendors on either side may be engaged to achieve better terms.

What does this mean to you?

Ensure a healthy internal discussion is ongoing around what the new combined business will look like and who will own responsibility to make different types of decisions BEFORE the actual transaction happens.

Some questions I like to review on a department level are:

- What will define Operational, Customer and Partner Value post-transaction?

- What shape will the Customer Journey look like for someone consuming products or services from either entity over the short, medium and longer-term?

- What economies of scale can be leveraged (suppliers, costs, tech, processes?)

- What operations are either side expected to be stronger? (people, product, process?)

- What support will be needed? (e.g. do you need to contract an integration development team for 3 – 6 months to support data migration efforts?).

- What decisions need to be made within the first 30, 60 and 90 days?

- How will we measure progress?

- What knowledge transfer will be required to capture synergies, make informed decisions, and drive your capability to maintain momentum within the first 120 days?.

- What technologies are expected to be integrated (via API), migrated or other?

- In the case of migrations, for how long would the legacy systems continue running? If they will run for an extended period, will it be in read-only mode, or will we need to synchronise data?

- What changes may be needed to the partner programs? Do we envisage to need to modify these programs in the short to medium term? Can our current systems support these models?

Success Factor 5: Proactively use the time interval between signing and closing!

Use the information you gathered so far to map out your ideal post-transaction integration plan. Be ready to share parts or all of it with your allocated integration partners:

- Stakeholder representatives from the Acquiring organisation

- Stakeholder representatives from the Target organisation

Treat your plans as a guideline journey/roadmap, and be open to approaching it in an Agile fashion.

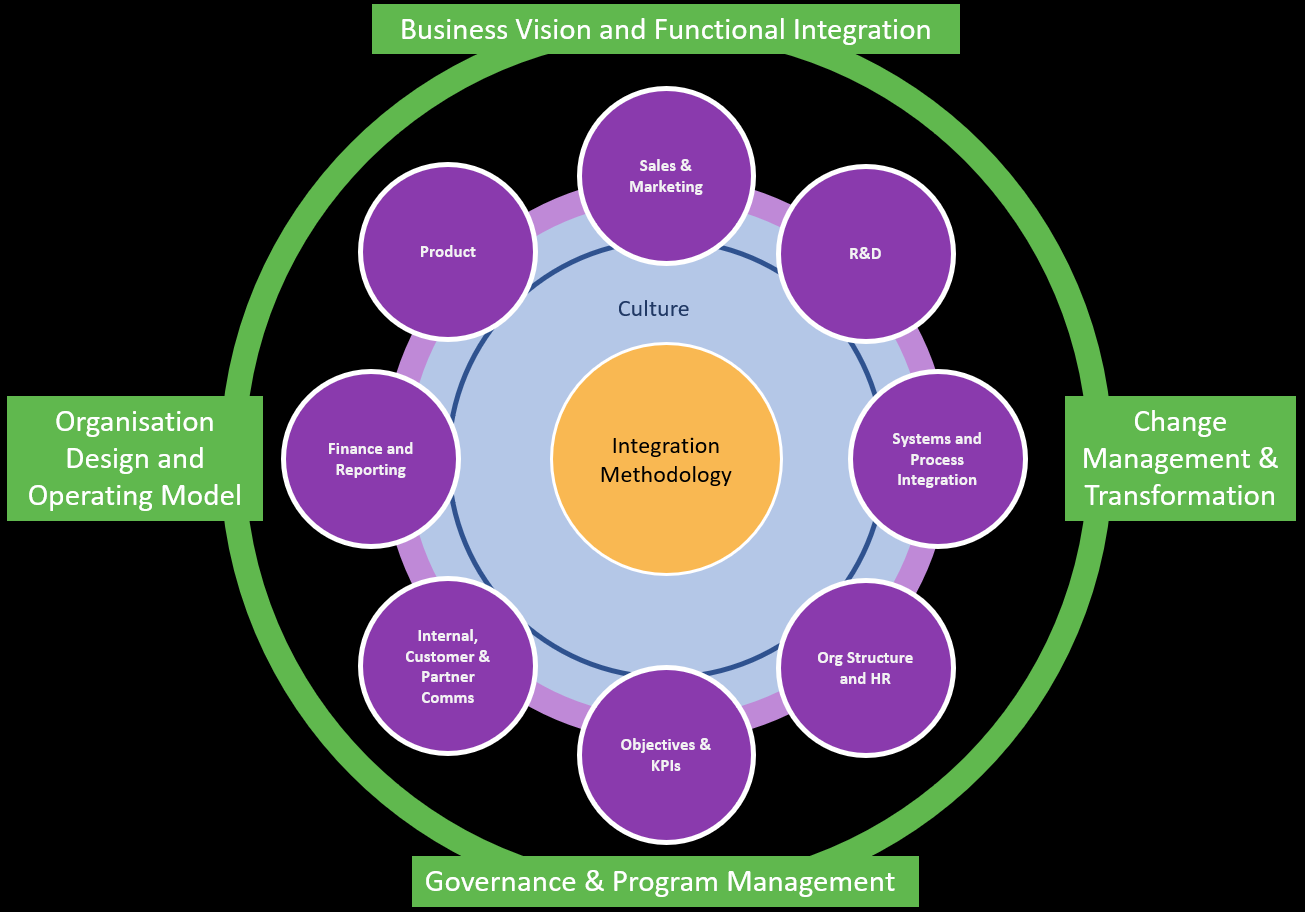

Support the teams by setting out clear expectations around the short, medium and longer-term transformation requirements covering:

- Purpose

- Team structure (roles, gearing ratios, capacity)

- Current teams and the identification of tribe leaders

- Overlap and redundancies in people, technologies and suppliers

- Data and Knowledge across customer, product, partners and go-to-market

- Technology & Systems such as CRM, ERP, Code Control

- Team engagements (involvement, training, policies)

- Business Processes and Workflows

- Products & Services (Maintain, Invest, Transform-To-Feature or End-of-life)

Review and use these expectations to identify areas that may need to be tackled before others or more tightly managed. These are generally the ones that have a higher risk and impact if unsuccessfully integrated. This level of preparation will allow you to identify dependencies and have an initial understanding of when some works need to be completed.

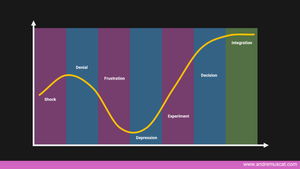

This understanding will unleash your ability to engage and partner with people in a positive way. You will be able to help people

- Visualise the journey being taken,

- Understand dependencies and sensitivities

- Establish their role

- Be in control of change and transformation

- Be informed and able to understand concerns and challenges.

- Track, report progress and escalate challenges.

It will also make you a most resourceful person when problem-solving situations you cannot predict will arise.

To be continued…

Head over to "9 Success Factors for M&A integrations (P3)" where we will focus on bringing the plan you built to life:

- Success Factor 6: Develop an integration strategy for Day 1

- Success Factor 7: Execute with confidence!

- Success Factor 8: Be prepared to handle the hard truths about integrations