Introduction

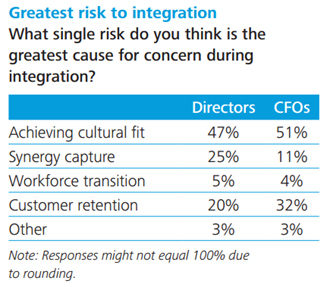

In M&A transactions, achieving a successful post-deal integration between the Acquirer and Target represents 49% of the concerns cited by CFOs and Boards globally. This concern is mainly driven by the unpredictability of cultural fit, driving a higher risk to reach the desired outcomes such as service differentiation, cost-synergies or economies-of-scale efficiencies modelled out as the part of the business case behind the acquisition.

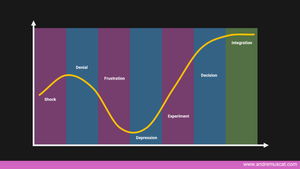

Make no mistake. Once a deal is signed, the journey needed to integrate organisations is delicate, complex and fraught with surprises. If unprepared, you will experience havoc and unnecessarily interrupt productivity across the board.

Your success will be based on your ability to instil wholeness, confidence, calm, and coherence in situations where there is fear and chaos. This is not simply achieved by applying a proper process or methodology to a situation.

You are in the business of people partnerships, change and transformation. This means the success of integration heavily depends on your approach and how you show up and behave, effectively determining the rate of necessary change you can drive and how.

Quoting William Tarry, M&A Services, Deloitte Consulting LLP, "In general, successful integration depends on having a dedicated, full-time team managing and overseeing the integration process. It cannot be delegated as a part-time job to people who will likely give priority to the day-to-day responsibilities on which they may be evaluated."

This post is built on my experiences executing over a dozen integrations across software businesses of varying sizes, complexity and domains. I use this blueprint to de-risk and achieve a higher engagement rate in the integration works I lead.

NOTE: For this post series, I am assuming that you have actively submitted a reasonably detailed range of cross-functional discovery questions covering people, product, process and partnerships as part of due diligence. This information will be critical in helping you navigate the integration preparation steps.

This three-part post series is dedicated to the integration process of M&A. We will explore eight core group of steps and success factors that, when approached with intent, drive a higher likelihood of success.

Agenda

In Part 1 (this post), we will explore the aspects that help you prepare for the journey ahead:

- Introduction

- Success Factor 1: Achieve clarity in purpose, direction and vision

- Success Factor 2: Building bridges!

In "9 Success Factors for M&A integrations (P2)" we focus on guiding you to build a plan of action with cross-functional engagement:

- Success Factor 3: Prepare your own business for the effort needed

- Success Factor 4: Manage risk and warning signs with intent!

- Success Factor 5: Proactively use the time interval between signing and closing!

In "9 Success Factors for M&A integrations (P3)" we will focus on bringing the plan to life:

- Success Factor 6: Develop an integration strategy for Day 1

- Success Factor 7: Execute with confidence!

- Success Factor 8: Be prepared to handle the hard truths about integrations

Success Factor 1: Achieve clarity in purpose, direction and vision

All integrations are different. You must have a reasonable grasp of how the business describes the purpose behind the acquisition, its current-state, future-state, and the definition of success in terms of cross-functional capabilities, time, cost, transformational velocity, milestones.

Be clear on the purpose of the acquisition and how it intends to operate post-transaction.

You will know you have reasonable clarity when you can articulate:

- Who is being acquired and what they do.

- The purpose behind the acquisition.

- The Investor objectives of value to be realised. E.g.:

- What success looks like in the short term (month one to three following deal-close), medium (month four to six following deal-close), and beyond (month seven and beyond).

- Whether the entities will co-exist as separate stand-alone businesses, be partially merged or have one fully ingested into the other?

- Any particular operating parameters such as compelling events, critical timelines, an expectation to current revenues, earnout sensitivities, committed product priorities.

Equipped with this information, you will be able to establish a clearer initial understanding of the journey required in terms of

- Where you are today and where you need to get to

- Which cross-functional teams need to be addressed with priority

- What instructions/parameters need to be documented for a successful kick-off

- What type of approach is best suited

- Which resources you may need from the cross-functional teams to support this integration.

Success Factor 2: Building bridges!

Remember, you are in the business of change and transformation. As an agent of change, M&A transactions impact both the organisation making the acquisition and the target being acquired.

The range of changes required from either side will vary. I would also venture (within limits) that these are quite strongly determined by the maturity of the internal systems, workflows and people within the acquiring organisation.

If this is your first, second or third acquisition, you will most likely still be refining your approach towards making M&A a core practice within your operation. On the other hand, if you are operating within a platform business, you are most likely equipped with a more robust set of internal systems, playbooks and maturity designed to expedite ingestion of acquired target businesses.

Platform businesses are typically identified by a series of acquisitions within a small time frame. Easily identifiable platform companies include Microsoft, Amazon, Alphabet, Apple and Facebook. As investments go, there are many lessons learned in each transaction.

Typical lessons from the acquiring side:

- Assume that executive leadership on the acquiring side can do better at communicating the value and expectations to their cross-functional teams

- Connect with, validate and verify that the cross-functional teams assign a named representative (or two) to ensure a consistent understanding of what needs to happen within their unit.

Typical lessons from the target side:

- Within the business being acquired, stakeholders will range from having contributed to the due-diligence processes to being completely oblivious that this transaction was happening.

- Understand that no matter their contribution to the transaction, they will most likely experience fear, uncertainty and doubt about their future.

- They will most likely be distrustful and cautious towards your intentions. They may already be planning their exit even before they met you or you opened your mouth.

Remember this: Once you do engage, you will need to swiftly help stakeholders build a bridge that links the overall acquisition story to the value their role will contribute to the business's transformation and continuity.

Your ability to be knowledgeable, personable and approachable while being able to detect and manage their emotions with empathy, resourcefulness and influence will be the key towards identifying assumptions and guiding people towards positively engaging on the journey to achieve a successful outcome.

To be continued…

Head over to "9 Success Factors for M&A integrations (P2)" where we on guiding you to build a plan of action with cross-functional engagement:

- Success Factor 3: Prepare your own business for the effort needed

- Success Factor 4: Manage risk and warning signs with intent!

- Success Factor 5: Proactively use the time interval between signing and closing!